Managing your business finances can be a challenging task, especially when it comes to keeping track of invoices, expenses, and taxes. Fortunately, accounting software can make this process much easier. If you’re looking for an efficient and easy-to-use tool to handle your financial tasks, you should consider using Best Invoiless Accounting Software. In this review, we will explore the best Invoiless Accounting Software options, helping you make the right decision for your business.

What is Invoiless Accounting Software?

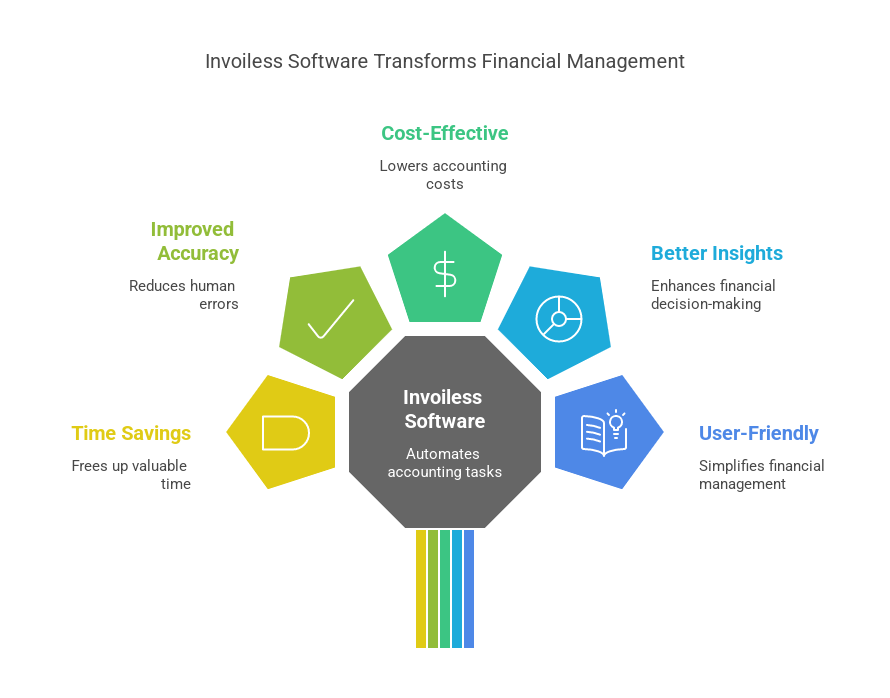

Invoiless Accounting Software is a digital tool designed to help small business owners and entrepreneurs manage their accounting tasks with ease. The software focuses on automating financial operations, such as invoicing, tracking expenses, and preparing tax reports. With Invoiless Accounting Software, businesses can save time and reduce the risk of errors, allowing them to focus more on growth and profitability.

Unlike traditional accounting methods that require manual data entry, Invoiless software offers automated features. These include automatic invoice generation, expense tracking, and financial reporting. It helps business owners gain better insight into their financial health and make informed decisions.

Why Use Invoiless Accounting Software?

There are several reasons why you should consider using Invoiless Accounting Software for your business:

- Time Savings: Automating routine accounting tasks helps you save time, so you can focus on more important aspects of your business.

- Accuracy: The software reduces human errors by automating calculations and ensuring that all data is correctly entered and tracked.

- Cost-Effective: Compared to hiring an accountant, using Invoiless software is much more affordable.

- Better Financial Insight: It provides you with reports and analysis, helping you make informed financial decisions.

- User-Friendly: Invoiless Accounting Software is typically easy to use, even for business owners with limited accounting knowledge.

Top Invoiless Accounting Software Options for Your Business

Here are some of the best Invoiless Accounting Software options available on the market:

- QuickBooks Online

QuickBooks Online is one of the most popular accounting software options available today. It’s known for its user-friendly interface and comprehensive features that cater to businesses of all sizes.

Key Features:

- Invoicing: QuickBooks allows you to create and send invoices to clients, track payments, and even set up recurring invoices.

- Expense Tracking: It automatically imports expenses from your bank account and categorizes them, making it easy to track where your money is going.

- Tax Calculation: QuickBooks automatically calculates taxes, so you don’t have to worry about making mistakes.

- Financial Reports: Generate detailed reports to assess your financial health, including profit and loss statements, balance sheets, and cash flow reports.

Pros:

- Great for businesses of all sizes

- Easy-to-use interface

- Seamless integration with other tools and apps

- Reliable customer support

Cons:

- The pricing can be a bit steep for small businesses.

- Some advanced features are only available in higher-tier plans.

Verdict: QuickBooks Online is perfect for small and medium-sized businesses looking for a robust accounting tool with a wide range of features.

- FreshBooks

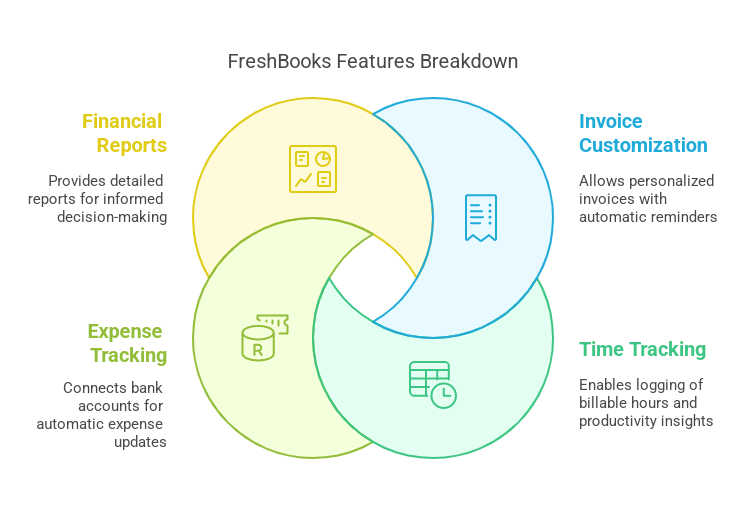

FreshBooks is an intuitive cloud-based accounting software designed with small business owners in mind. It’s particularly known for its invoicing capabilities and user-friendly interface.

Key Features:

- Invoice Customization: FreshBooks allows you to create personalized invoices, add logos, and set up automatic reminders for overdue payments.

- Time Tracking: FreshBooks makes it easy to track the time you spend on client projects, which is helpful for billing clients.

- Expense Tracking: You can track expenses by connecting your bank account or manually adding receipts.

- Financial Reports: FreshBooks provides detailed financial reports, such as profit and loss statements, tax summaries, and account balances.

Pros:

- Simple and easy-to-use interface

- Excellent invoicing and time tracking features

- Automated reminders for overdue invoices

- Great customer support

Cons:

- Limited to small businesses and freelancers

- Some features (e.g., reporting) are less robust than in other tools like QuickBooks.

Verdict: FreshBooks is a great choice for freelancers and small businesses looking for simple invoicing and expense-tracking tools.

- Xero

Xero is another top contender in the accounting software space. It is known for its strong features and powerful reporting capabilities. It’s ideal for businesses that need a little more flexibility and customization in their accounting tools.

Key Features:

- Invoicing & Quotes: Xero allows you to create professional invoices and quotes that can be customized to fit your branding.

- Expense Tracking: The software automatically syncs with your bank account to track and categorize your business expenses.

- Payroll Management: Xero includes a payroll system to manage employee payments and taxes.

- Financial Reports: With Xero, you can generate comprehensive financial reports to get a clear picture of your business’s performance.

Pros:

- Robust and customizable features

- Great for businesses with multiple employees

- Excellent financial reporting and analysis

- Seamless integration with third-party apps

Cons:

- A bit more complex to use compared to FreshBooks and QuickBooks

- Some features require higher-tier plans

Verdict: Xero is ideal for businesses that need advanced features and flexibility, particularly in managing payroll and financial reporting.

- Wave

Wave is a free accounting software that offers essential features for small business owners and freelancers. It’s a great option for those who are looking for a cost-effective solution without sacrificing functionality.

Key Features:

- Free Invoicing & Accounting: Wave allows you to create invoices, track expenses, and manage your accounting for free.

- Receipt Scanning: You can take a picture of your receipts and upload them to track your expenses.

- Reports: Wave generates simple financial reports to help you stay on top of your business’s finances.

Pros:

- Completely free to use

- Simple and easy to navigate

- Good for small businesses and freelancers on a budget

Cons:

- Lacks advanced features found in other tools like QuickBooks and Xero

- Limited customer support options

Verdict: Wave is perfect for freelancers and small businesses that need basic accounting features without the extra cost.

- Zoho Books

Zoho Books is an affordable and powerful accounting software designed for small businesses. It’s part of the Zoho suite of tools, which makes it an excellent choice for businesses already using other Zoho products.

Key Features:

- Customizable Invoices: Zoho Books allows you to create and send customized invoices.

- Expense Tracking: You can track both recurring and one-time expenses easily, making it perfect for businesses with regular costs.

- Automated Workflows: Zoho Books can automate invoicing and reminders for overdue payments.

- Detailed Reports: Zoho Books provides detailed financial reports to give you a comprehensive view of your business’s performance.

Pros:

- Affordable pricing

- Strong invoicing and expense tracking features

- Good integration with other Zoho tools

- Easy-to-use interface

Cons:

- Limited payroll features compared to competitors

- Customer support can be slow at times

Verdict: Zoho Books is an excellent option for small businesses that need a budget-friendly, comprehensive accounting solution.

Frequently Asked Questions (FAQs)

- What is the best Invoiless Accounting Software for small businesses? The best Invoiless Accounting Software for small businesses depends on your needs. QuickBooks and FreshBooks are both great options, offering robust features for invoicing, expense tracking, and reporting.

- Can I use Invoiless Accounting Software for payroll management? Yes, some Invoiless Accounting Software tools, like QuickBooks and Xero, include payroll management features to help you pay employees and calculate taxes.

- Is there any free Invoiless Accounting Software? Wave is a popular free option for small businesses and freelancers looking for basic invoicing and accounting features. It’s a great choice for businesses on a tight budget.

- How does Invoiless Accounting Software help with taxes? Most Invoiless Accounting Software tools automatically calculate sales taxes, generate tax reports, and help you prepare for tax filing. QuickBooks and Xero, for example, offer detailed tax reports.

- What are the advantages of using Invoiless Accounting Software? The advantages include time savings, improved accuracy, cost-effectiveness, and better financial insight. It can simplify invoicing, expense tracking, and financial reporting, making accounting tasks much easier.

Conclusion

Invoiless Accounting Software is a valuable tool for small businesses and freelancers who want to simplify their financial management. Whether you’re looking for a powerful all-in-one solution like QuickBooks or an affordable option like Wave, there is software to meet your needs. By using one of these top Invoiless Accounting Software options, you can streamline your accounting tasks, reduce errors, and focus on growing your business.

Watch This Video to Learn More